IRS 4768 2020-2026 free printable template

Show details

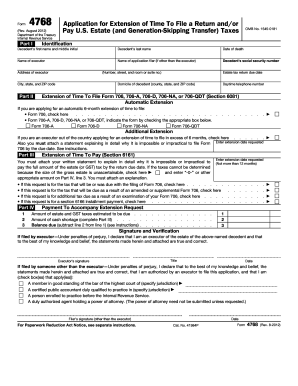

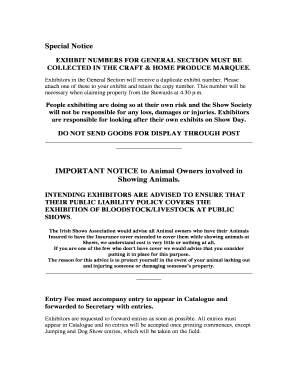

Cat. No. 41984P Rev. 8-2012 Form 4768 Rev. 8-2012 Part V Page Notice to Applicant To be completed by the Internal Revenue Service Note. Form Rev* August 2012 Department of the Treasury Internal Revenue Service Part I Application for Extension of Time To File a Return and/or Pay U*S* Estate and Generation-Skipping Transfer Taxes OMB No* 1545-0181 Identification Decedent s first name and middle initial Decedent s last name Date of death Name of executor Name of application filer if other than...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 4768 instructions

Edit your irs form 4768 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs 4768 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 4768 form online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 4768 extension. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 4768 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 4768 irs

How to fill out IRS 4768

01

Obtain the IRS Form 4768 from the IRS website or a tax professional.

02

Fill in the decedent's name, Social Security number, and date of death in the appropriate sections.

03

Indicate the type of return being filed (Form 706/706-NA) in the designated box.

04

Provide information regarding the estate, including the gross estate value and any deductions.

05

Calculate the estate tax using the provided worksheets and instructions.

06

Specify the payment method for any taxes owed.

07

Sign and date the form, ensuring to include your title if signing on behalf of the estate.

08

Submit Form 4768 to the IRS by the designated due date.

Who needs IRS 4768?

01

The IRS Form 4768 is required for estates that need an extension of time to file Form 706 (United States Estate (and Generation-Skipping Transfer) Tax Return) or Form 706-NA (United States Estate Tax Return for Nonresident Aliens).

02

It is typically needed by the executor or administrator of the estate.

Fill

irs form 4768 instructions

: Try Risk Free

People Also Ask about form 4768 instructions 2025

How do I get my tax forms from the IRS?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How do I get a copy of my 1099 from the IRS?

If they don't receive the missing or corrected form from their employer or payer by the end of February, they may call the IRS at 800-829-1040 for help. They'll need to provide their name, address, phone number, Social Security number and dates of employment.

What is IRS Form 1040?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

How do I get 1040 forms from previous years?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

How can I retrieve a copy of my 1040?

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 4768 instructions online?

pdfFiller has made filling out and eSigning form 4768 pdf easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I edit estate tax in wa state on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing how to get annual income tax return, you need to install and log in to the app.

How do I fill out the IRS 4768 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS 4768 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IRS 4768?

IRS Form 4768 is an application for an extension of time to file a estate tax return and/or pay the estate tax.

Who is required to file IRS 4768?

The executor or administrator of an estate is typically required to file IRS Form 4768 if they need additional time to file the estate tax return or pay the estate tax.

How to fill out IRS 4768?

To fill out IRS Form 4768, you need to provide the decedent's information, details about the executor or administrator, the reason for the extension, and the requested extension period. Ensure all required fields are completed and any applicable fees are submitted.

What is the purpose of IRS 4768?

The purpose of IRS Form 4768 is to request an extension of time to file the estate tax return and/or to pay any associated estate taxes.

What information must be reported on IRS 4768?

The information that must be reported on IRS Form 4768 includes the name and address of the decedent, the name and address of the executor, the reason for the extension, and any amounts of tax owed if applicable.

Fill out your IRS 4768 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 4768 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.