Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

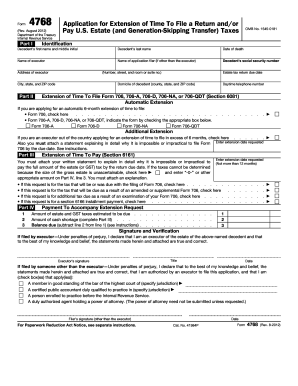

How to fill out tax forms from form?

1. Gather all necessary documents. Before you begin filling out a tax form, make sure you have all the documents you need to complete the form accurately. This may include your W-2 forms, 1099 forms, receipts for any deductions or credits you plan to claim, bank account information, and other documents.

2. Read the instructions carefully. Before you start filling out the form, make sure you have read the instructions carefully. The instructions will tell you which sections of the form need to be filled out, what information needs to be included, and any other important information about the form.

3. Enter your personal information. On the form, you will usually need to provide information such as your name, address, Social Security number, and filing status.

4. Enter your income information. Depending on the form, you may need to enter information about your wages, interest, dividends, and other types of income.

5. Claim any deductions or credits you are eligible for. Depending on the form, you may be able to claim deductions or credits such as the Earned Income Tax Credit or the Child Tax Credit. Make sure to check the instructions to see what deductions and credits you are eligible for.

6. Calculate your taxes. Use the form to calculate your total tax liability. Make sure to double-check your calculations to ensure they are correct.

7. Sign the form. Once you have completed the form, make sure to sign it before submitting it.

What information must be reported on tax forms from form?

On tax forms, the individual or business must report their name, address, Social Security number (or employer identification number for businesses), income, deductions, credits, and any other information required by the form.

When is the deadline to file tax forms from form in 2023?

The deadline to file your tax forms for 2023 will be April 15, 2024.

What is the penalty for the late filing of tax forms from form?

The penalty for late filing of tax forms varies depending on the form and the circumstances. Generally, the penalty for late filing is 5% of the unpaid taxes for each month or part of a month that a tax return is late, up to a maximum of 25%. In addition, there may be a penalty of up to $205 or 100% of the unpaid tax, whichever is smaller.

What is tax forms from form?

Tax forms are documents that individuals, businesses, or organizations must complete and submit to the government to report their income, expenses, and other relevant financial information for the purpose of calculating and paying taxes. These forms provide the necessary information to determine how much tax is owed or if a refund is due. Different types of tax forms exist for various types of taxpayers and tax obligations, such as income tax, sales tax, employment tax, and more. Examples of tax forms include the 1040 series for individual income tax returns, Form 941 for employer's quarterly federal tax return, Form 1099 for reporting certain types of income, and Form W-4 for withholding allowances.

Who is required to file tax forms from form?

The individuals who are required to file tax forms varies based on their specific circumstances. However, generally, anyone who earns income above certain thresholds, such as a certain amount of gross income or self-employment earnings, is required to file tax forms. Additionally, individuals who meet other criteria, such as having certain types of income or claiming certain tax credits, may also be required to file taxes. It is advisable to consult the guidelines provided by the tax authorities in your country to determine if you are required to file tax forms.

What is the purpose of tax forms from form?

The purpose of tax forms is to report information related to an individual's or organization's income, expenses, deductions, and tax liabilities. These forms provide a standardized format for taxpayers to accurately report their financial information to the government, specifically the Internal Revenue Service (IRS) in the United States. Tax forms are used to calculate the amount of tax owed or the refund due to the taxpayer. They help ensure compliance with tax laws and enable the government to collect taxes necessary to fund public services and programs.

How do I execute form 4768 instructions online?

pdfFiller has made filling out and eSigning form 4768 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I edit irs form 4768 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 4768, you need to install and log in to the app.

How do I fill out the irs 4768 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign form 4768 extension and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.